Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

The picture emerging from the Q4 earnings season is one of continued strength and momentum, particularly on the revenue side. With respect to earnings, the aggregate total is on track to reach a new all-time quarterly record, which would mark the third quarter in a row of record dollar earnings.

That said, the well-known headwinds of cost pressures and logistical bottlenecks have been weighing on margins and causing many operators to miss consensus EPS estimates.

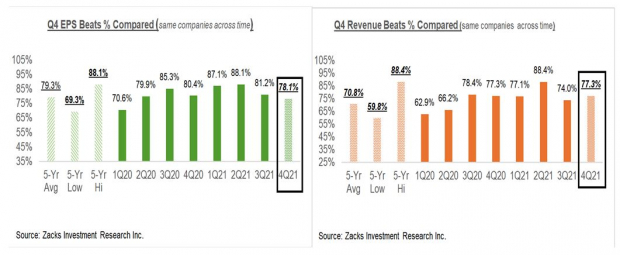

You can see this in the comparison charts below that compare the EPS and beats percentages for the 388 index members that have reported already with what we had seen from the same group of companies in other recent periods.

Image Source: Zacks Investment Research

You can see here that the EPS beats percentage is not only below what we had seen in the first three quarters of the year, but is also below the 5-year average for this group of 388 index members.

There is no such issue on the revenues side, as the right-hand chart above shows.

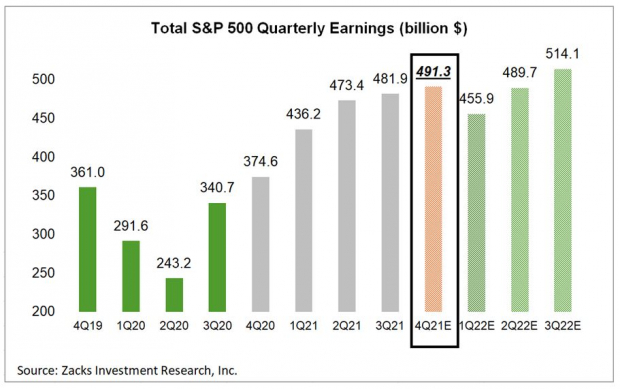

Fewer EPS beats notwithstanding, 2021 Q4 is on track to reach a new all-time quarterly record, as the chart below shows.

Image Source: Zacks Investment Research

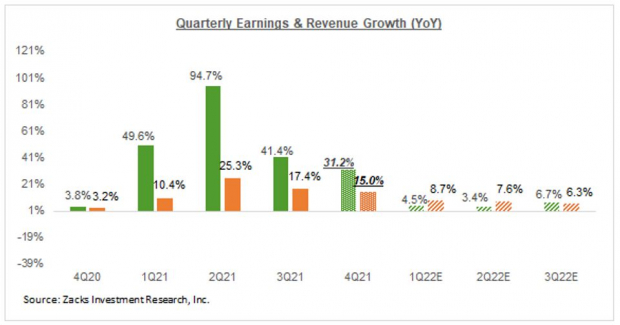

Looking at Q4 as a whole, total earnings for the quarter are expected to be up +31.2% from the same period last year on +15.0% higher revenues. The growth pace decelerates significantly in the following periods, as you can see in the chart below that provides a big-picture view of earnings on a quarterly basis.

Image Source: Zacks Investment Research

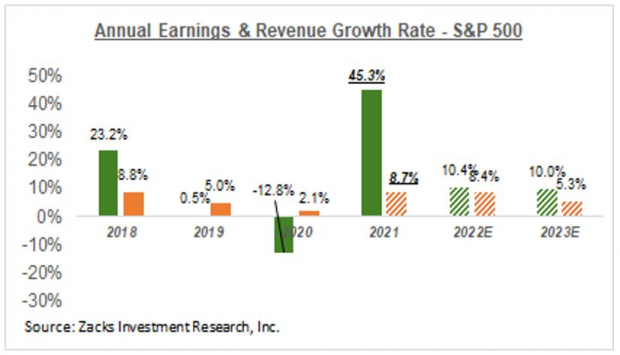

The chart below shows the overall earnings picture on an annual basis, with the growth momentum expected to continue.

Image Source: Zacks Investment Research

We remain positive in our earnings outlook, as we see the overall growth picture steadily improving, as Omicron’s effects start easing and the near-term logistical issues get addressed.

Image: Bigstock

Record Earnings in Q4 Despite Economic Headwinds

Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

The picture emerging from the Q4 earnings season is one of continued strength and momentum, particularly on the revenue side. With respect to earnings, the aggregate total is on track to reach a new all-time quarterly record, which would mark the third quarter in a row of record dollar earnings.

That said, the well-known headwinds of cost pressures and logistical bottlenecks have been weighing on margins and causing many operators to miss consensus EPS estimates.

You can see this in the comparison charts below that compare the EPS and beats percentages for the 388 index members that have reported already with what we had seen from the same group of companies in other recent periods.

Image Source: Zacks Investment Research

You can see here that the EPS beats percentage is not only below what we had seen in the first three quarters of the year, but is also below the 5-year average for this group of 388 index members.

There is no such issue on the revenues side, as the right-hand chart above shows.

Fewer EPS beats notwithstanding, 2021 Q4 is on track to reach a new all-time quarterly record, as the chart below shows.

Image Source: Zacks Investment Research

Looking at Q4 as a whole, total earnings for the quarter are expected to be up +31.2% from the same period last year on +15.0% higher revenues. The growth pace decelerates significantly in the following periods, as you can see in the chart below that provides a big-picture view of earnings on a quarterly basis.

Image Source: Zacks Investment Research

The chart below shows the overall earnings picture on an annual basis, with the growth momentum expected to continue.

Image Source: Zacks Investment Research

We remain positive in our earnings outlook, as we see the overall growth picture steadily improving, as Omicron’s effects start easing and the near-term logistical issues get addressed.